The 2020 housing market was unexpectedly turbulent towards the end of the first quarter due to the pandemic that spread across the country. As the first wave of COVID-19 hit in the spring, housing market activity slowed substantially before staging a dramatic comeback just a couple months later. Buyer activity was the leader again in 2020. With mortgage interest rates setting record lows multiple times throughout the year and a strong drive by many buyers to secure a better housing situation – in part due to the new realities brought on by COVID-19 – many segments of the market experienced a multiple-offer frenzy not seen in the last 15 years or more. While markedly improved from their COVID-19 spring lows, seller activity continued to lag buyer demand, which had strengthened the ongoing seller’s market for most housing segments as inventories remain at record lows.

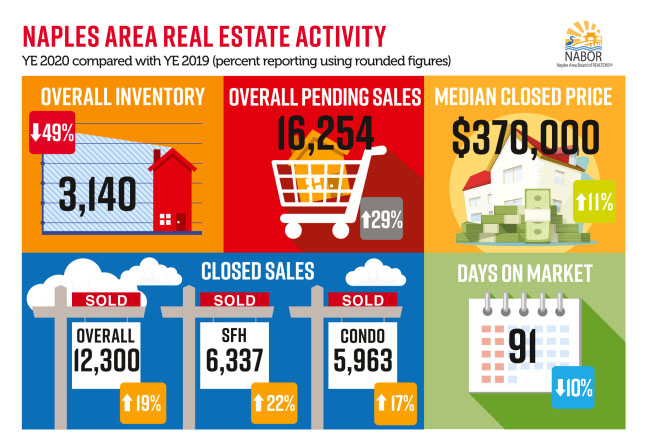

Sales: Total sales were up 19.4 percent to end the year at 12,300.

Prices: Home prices were up compared to last year. The overall median sales price increased 11.4 percent to $370,000 for the year. Single Family home prices were up 14.4 percent compared to last year, and Townhouse-Condo home prices were up 7.7 percent.

List Price Received: Sellers received, on average, 96.0 percent of their original list price at sale, up 0.5 percent from last year.

Listings: Comparing 2020 to the prior year, the number of homes available for sale was lower by 49.1 percent. There were 3,140 active listings at the end of 2020. New listings increased by 0.9 percent to finish the year at 15,582.

Sales by Price Range: The number of homes sold in the $2,000,001 and above price range rose 70.9 percent to 776 homes. Homes sold in the $300,000 price range were fell 0.2 percent to 4,384 homes.

Bedroom Count: Increases in sales prices occurred across homes of all sizes over the last year. In 2020, properties with 4 bedrooms or more saw the largest growth at 37.7 percent. The highest percent of original list price received at sale went to properties with 3 bedrooms at 96.4 percent.

The housing market in 2020 proved to be incredibly resilient, ending the year on a high note. Home sales and prices were higher than 2019 across most market segments and across most of the country. Seller activity recovered significantly from the COVID-19 spring decline, but overall activity was still insufficient to build up the supply of homes for sale.

As we look to 2021, signals suggest buyer demand will remain elevated and tight inventory will continue to invite multiple offers and higher prices across much of the housing inventory. Mortgage rates are expected to remain low, helping buyers manage some of the increases in home prices and keep them motivated to lock in their housing costs for the long term. These factors will provide substantial tailwinds for the housing market into the new year.

This information is courtesy of the Naples Area Board of REALTORS® (NABOR)